fremont ca sales tax rate 2019

How to find username of wifi router. Above 100 means more expensive.

Food And Sales Tax 2020 In California Heather

S corporation bank and financial rate.

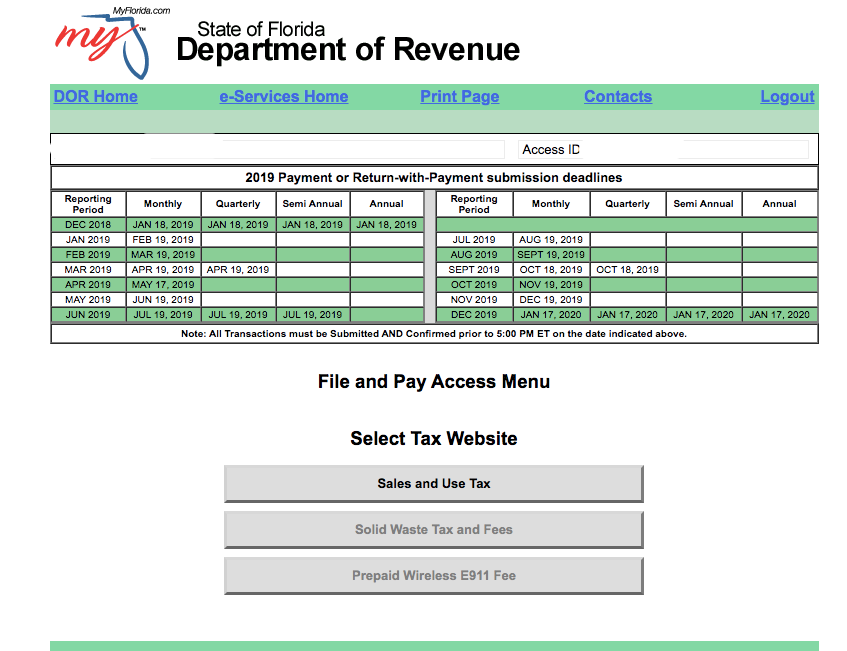

. 100 US Average. 2020 rates included for use while preparing your income tax deduction. 127 rows Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent.

Many local sales and use tax rate changes take effect on April 1 2019 in California as befits its size. The tax rate given here will reflect the current rate of tax for the address that you enter. Fremont CA Sales Tax Rate.

The California sales tax rate is currently. Taxes in Fremont California are 553 more expensive than Elk Grove California. Wayfair Inc affect California.

This is the total of state county and city sales tax rates. The County sales tax rate is. City sales and use tax rate.

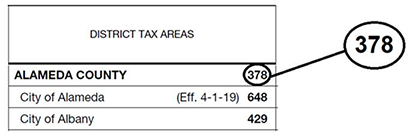

1565 Reliance Way Fremont CA 94539 was built in 1998 and has a current tax assessors market value of 13800267. When was 36854 Riviera Drive Fremont CA 94536 last sold and what was the last sale price. The Alameda County California sales tax is 925 consisting of 600 California state sales tax and 325 Alameda County local sales taxesThe local sales tax consists of a 025 county sales tax and a 300 special district sales tax used to fund transportation districts local attractions etc.

Alternative Minimum Tax AMT rate. The current total local sales tax rate in Fremont CA is 10250. Three cities follow with combined rates of 10 percent or higher.

5 digit Zip Code is required. Groceries and prescription drugs are exempt from the California sales tax. Fast Easy Tax Solutions.

The latest sales tax rate for Fremont CA. The latest sales tax rates for cities in California CA state. Tacoma 102 percent and Seattle 101 percent Washington and Birmingham Alabama 10 percent.

Bakersfield CA Sales Tax Rate. Below 100 means cheaper than the US average. Mario party 2 wii u controllers.

Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 10. Business New Sales and Use Tax Rates in Fremont East Bay Effective April 1 California State Board of Equalization officials say the rates apply only within the indicated city limits or county lines. See reviews photos directions phone numbers and more for Sales Tax Rate locations in Fremont CA.

Some areas may have more than one district tax in effect. January 2019 725. -325 lower than the maximum sales tax in The 1025 sales tax rate in Fremont consists of 6 Puerto Rico state sales tax 025 Alameda County sales tax and 4 Special tax.

Is make sure an imperative verb. Fremont ca sales tax rate 2021 fremont ca sales tax rate 2021 fremont ca sales tax rate 2021. County Tax City Tax Special Tax.

California has 2558 special sales tax jurisdictions with local sales taxes in. The Fremont sales tax rate is. There is no applicable city tax.

100 US Average. Taxes in Fremont California are 696 more expensive than Seattle Washington. Fremont CA Sales Tax Rate.

Garden Grove CA Sales Tax Rate. A combined city and county sales tax rate of 325 on top of Californias 6 base makes Fremont one of the more expensive cities to shop in with 1766 out of 1782 cities having a sales tax rate this low or lower. Sellers are required to report and pay the applicable district taxes for their taxable.

Melissa and joey lennox and marco. 2020 rates included for use while preparing your income tax deduction. This rate includes any state county city and local sales taxes.

Fresno CA Sales Tax Rate. Those district tax rates range from 010 to 100. The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma 442 percent.

The minimum combined 2022 sales tax rate for Fremont California is. Rates include state county and city taxes. Type an address above and click Search to find the sales and use tax rate for that location.

The California state sales tax rate is 75 and the average CA sales tax after local surtaxes is 844. What is the sales tax rate in Fremont California. The Alameda County Sales Tax is collected by the merchant on all qualifying sales made.

The December 2020 total local sales tax rate was 9250. About our Cost of Living Index. Above 100 means more expensive.

1788 rows California Department of Tax and Fee Administration Cities. Did South Dakota v. The Fremont sales tax rate is.

Below 100 means cheaper than the US average. Fontana CA Sales Tax Rate. What is the year built the current market value of 1565 Reliance Way Fremont CA 94539.

You are leaving ftbcagov. Ad Find Out Sales Tax Rates For Free. How does the Fremont sales tax compare to the rest of CA.

Assessed at 1450614 the tax amount paid for 36854 Riviera Drive Fremont CA 94536 is 16424. The County sales tax rate is. California Franchise Tax Board Certification date July 1 2021.

36854 Riviera Drive Fremont CA 94536 was last sold in. What was the temperature in amarillo texas today. About our Cost of Living Index.

Average local rates rose the most in Florida jumping the state from the 28th highest combined rate to the 22nd highest. Corporations other than banks and financials. Poetic diction by wordsworth.

The statewide tax rate is 725. Please ensure the address information you input is the address you intended. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller.

Food And Sales Tax 2020 In California Heather

Colorado Property Tax Calculator Smartasset

File Sales Tax By County Webp Wikimedia Commons

How Do I Fill Sales Tax Celebrity Tn N 1 Official Stars People Magazine Wiki Biography News

Food And Sales Tax 2020 In California Heather

California Sales Tax Rates By City County 2022

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Sales Tax Rates In Major Cities Tax Data Tax Foundation

California City County Sales Use Tax Rates

California Sales Tax Guide For Businesses

Information For Local Jurisdictions And Districts

Why Households Need 300 000 To Live A Middle Class Lifestyle

Sales Tax On Cars And Vehicles In Nebraska

California Sales Tax Rates By City

Why Tax Is Less In Washington Seattle Compared To California Quora

California State County City Municipal Tax Rate Table Sales Tax Number Reseller S Permit Online Application